If you lead with emotion, performance will follow

May 11, 2022

Written by: William Johnson, Division VP, Sales & Channel

(View Author Bio)

Money may talk, but you need a lot of it to change behavior. Learn how to leverage cash and non-cash incentives to motivate your sales team.

__________

In the multi-billion dollar field of sales compensation programs, there is one topic that seems to generate more research, debate and division than all others: What is the most effective approach to incentives, recognition and rewards — cash or non-cash? In other words, will your salespeople work harder to earn a cash bonus or points to use on tangible awards?

__________

The reasoning behind a cash-based reward program appears quite simple and rational: reward increased performance with more money. A non-cash program rewards increased performance with points. As the points accumulate, they are redeemable for merchandise, experiences or travel.

The interesting thing is your sales force may say they want the extra money but the reality is somewhat different. Numerous academic studies have proven people will actually work harder to earn tangible items. But why?

It’s because of behavioral economics. At BI WORLDWIDE, we use the principles of behavioral economics to incentivize behavior change and deliver measurable results. What is behavioral economics? It’s when rational thought and emotions combine to drive decisions and behavior.

In the 1980s, American economic professors began to question classical economic theories as they relate to individuals. This led to the creation of behavioral economics, with the focus on how people actually behave rather than how classical economic theories predict they will.

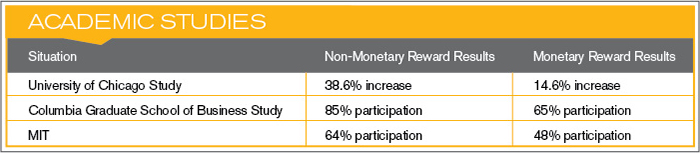

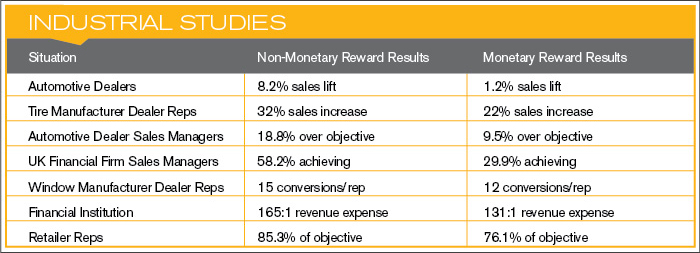

Today, this growing field of study has proven what we have always known on an intuitive level: people are often inconsistent and irrational in the actions they take. On the surface, it would seem the rational response from a commission-based sales force would be to work harder for a cash reward. After all, their occupation is based on the concept of being monetarily compensated for a job well done. But as the graphics below indicate, sales teams in a number of academic studies and across a wide range of industries made the seemingly irrational choice — they performed significantly higher when they were rewarded with non-cash incentives.

These examples prove what’s at the heart of behavioral economics: The majority of behavior is driven by emotion (77%) versus reason (23%).

This behavior is explained by the primary consideration for cash — it disappears into day-to-day necessities. Any extra money earned is first used to meet basic living expenses and pay bills. (That’s behavior driven by reason.) Only after those needs are taken care of do we let our emotions take over to think about using it on things we want or desire. Because paying our bills or buying gas and groceries drains the emotion out of the reward, money ends up being a less efficient motivator.

As you consider the impact this has on the incentives, recognition and rewards you use with your sales teams, tap into what makes points more effective than cash. They put people who earn them into an emotional mindset focused on dreams and possibilities, eliciting the type of performance that moves a business forward.

Remember, money may talk but you need a lot of it to change behavior.

The best way to get started is to get in touch.