The power of purple shirts

Jun 14, 2022

Written by: Jonathan Kraus, VP, Automotive Design

(View Author Bio)

Automotive OEMs have an abundance of channel data, from sales to staffing to certification. But knowing what to do with that data can be challenging. Learn how to maximize qualitative insights to drive dealer performance.

Scroll Down

__________

Did you know...

If dealership sales and service teams exclusively wear purple shirts, they’ll realize an average 15% increase in both new vehicle sales and dollars per repair order?

Neither did we (nor did anyone else, as far as we can tell).

So, why not?

__________

While not always optimized or unified, automotive OEMs are replete with dealer data. Sales, operational efficiency, lead close, staffing, retention, certification — you name it. If it’s quantifiable, chances are OEMs (and their dealers) are tracking and analyzing it. But that data only illustrates results and net impact. It can’t (and doesn’t) capture the why.

• Why is Dealer X exceeding sales targets in a down market?

• Why is SSI/CSI at Dealer Y lagging behind regional and national averages?

• Why is one dealer performing radically differently than another in a quantitatively equivalent AOR?

It’s in the qualitative aspects of dealer operations – the day-to-day processes, strategies, people and behaviors – that the “why” resides.

Therein lies the challenge.

Under the current paradigm of the OEM/dealer relationship, isolating those variables of performance is nearly impossible. There are infinite reasons why one dealership succeeds while another fails. After all, they’re a collection of independent businesses bound only by broad dealer agreements that, by design, “leave it to them” to unlock keys to success within their AOR.

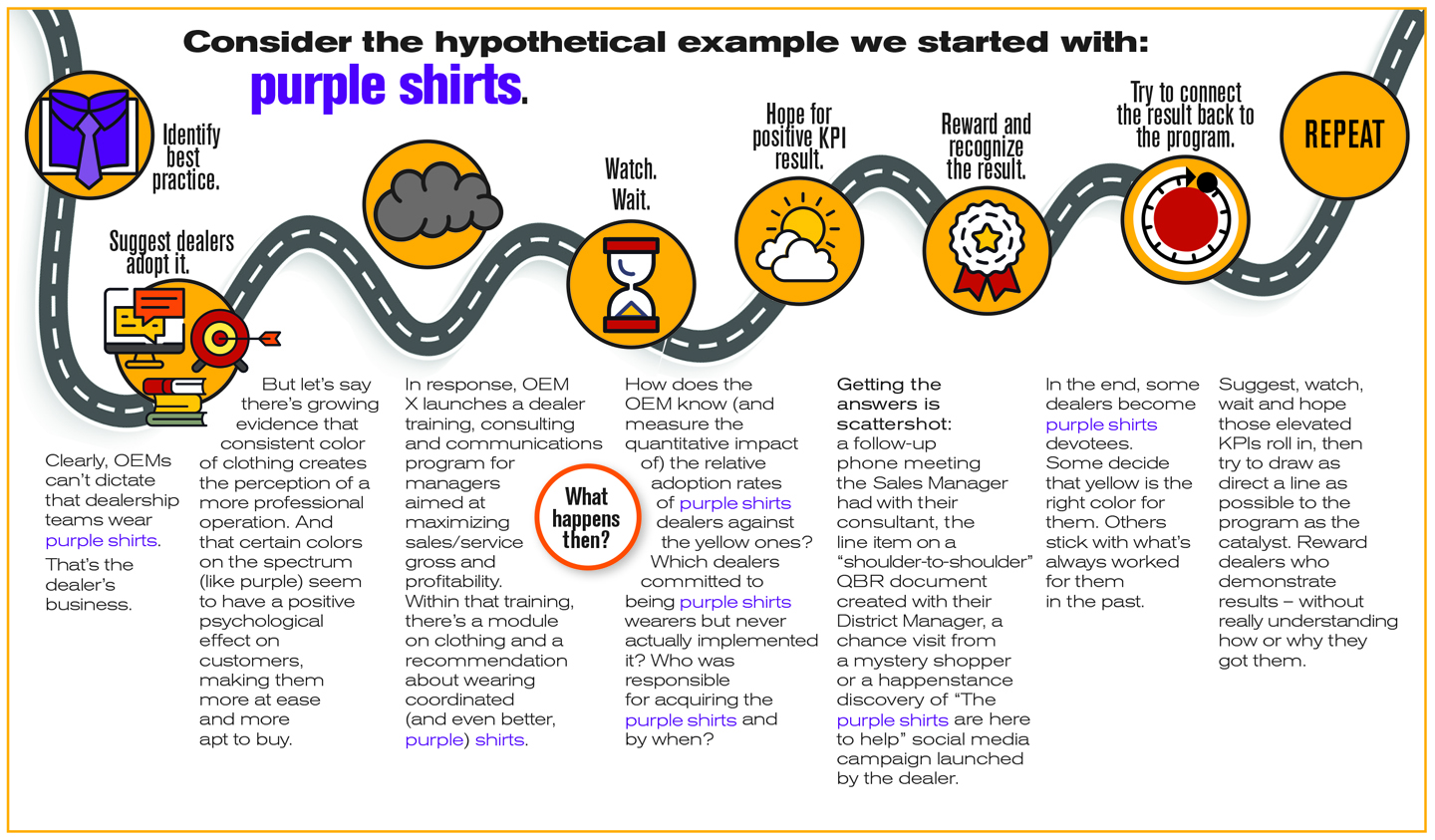

But that doesn’t keep the industry from trying to better communicate, train and reward on the “why”. OEMs, field organizations and a multitude of third-party firms sponsor and deploy hundreds of qualitative dealer assessment, process improvement and “standards” initiatives every year, such as:

• Customer satisfaction (CX)

• Intra-departmental core process

• Digital marketing

• Facilities and merchandising

• Certification and training

• Express Maintenance

These represent hundreds of millions of dollars in investment and are often supported by dedicated departments of OEM/field oversight. And while well-intended and usually well-designed, these programs only define what dealers could and should do. Afterwards, though, it’s largely watch, wait and hope for the desired quantitative results to roll in.

The final steps in the process are typically:

• Reward and recognize the quantitative results (though often without a real understanding of what drove them).

• Perform validating research to determine program efficacy as best we can (isolate the “why”) and either re-invest or cut bait.

The critical gap here is in the measurement, analysis and application of learnings about what the dealer actually does or doesn’t do. And that represents an enormous missed opportunity.

For most, those rich qualitative insights (what the dealer did) start and end with that dealer. At best, they’re shared with the frontline field team, housed in an Excel file or group folder and infrequently make their way to the OEM as anecdotal evidence of some potential best (or worst) practice, or picked up by Automotive News for a feature article in its “Dealer Best Practices” column.

That is, by not collecting and quantifying trends in dealer performance actions and inactions in a consistent, repeatable and systematic manner, the “secret sauce” of dealer performance optimization remains forever a mystery to the network (and the OEM) at large.

Where does this leave us?

OEMs will never have an omniscient view of dealer operations and best practices (nor should they). But the way OEMs are capturing, cataloguing and using qualitative dealer performance insight to the benefit of the entire network can and should evolve.

The critical objectives:

• Make dealer business planning easier and more consistent.

• Consolidate and standardize dealer assessment, action planning and qualitative reporting across departments and programs.

• Foster more accountability and visibility to progress and follow-through. • Draw clearer lines between individual programs and their contribution to performance results.

• Capture macro trends in qualitative performance gaps or best practices that translate to more relevant learning, performance support and recognition programming.

__________

As an OEM, understanding the “why” and leveraging qualitative insights will help you isolate variables of dealer performance that

make a difference in your business.

__________

The best way to get started is to get in touch.