Measuring the real value of customer behaviors

Written by: Jim Bergeson, VP, Customer Engagement Group, BI WORLDWIDE

(View Author Bio)

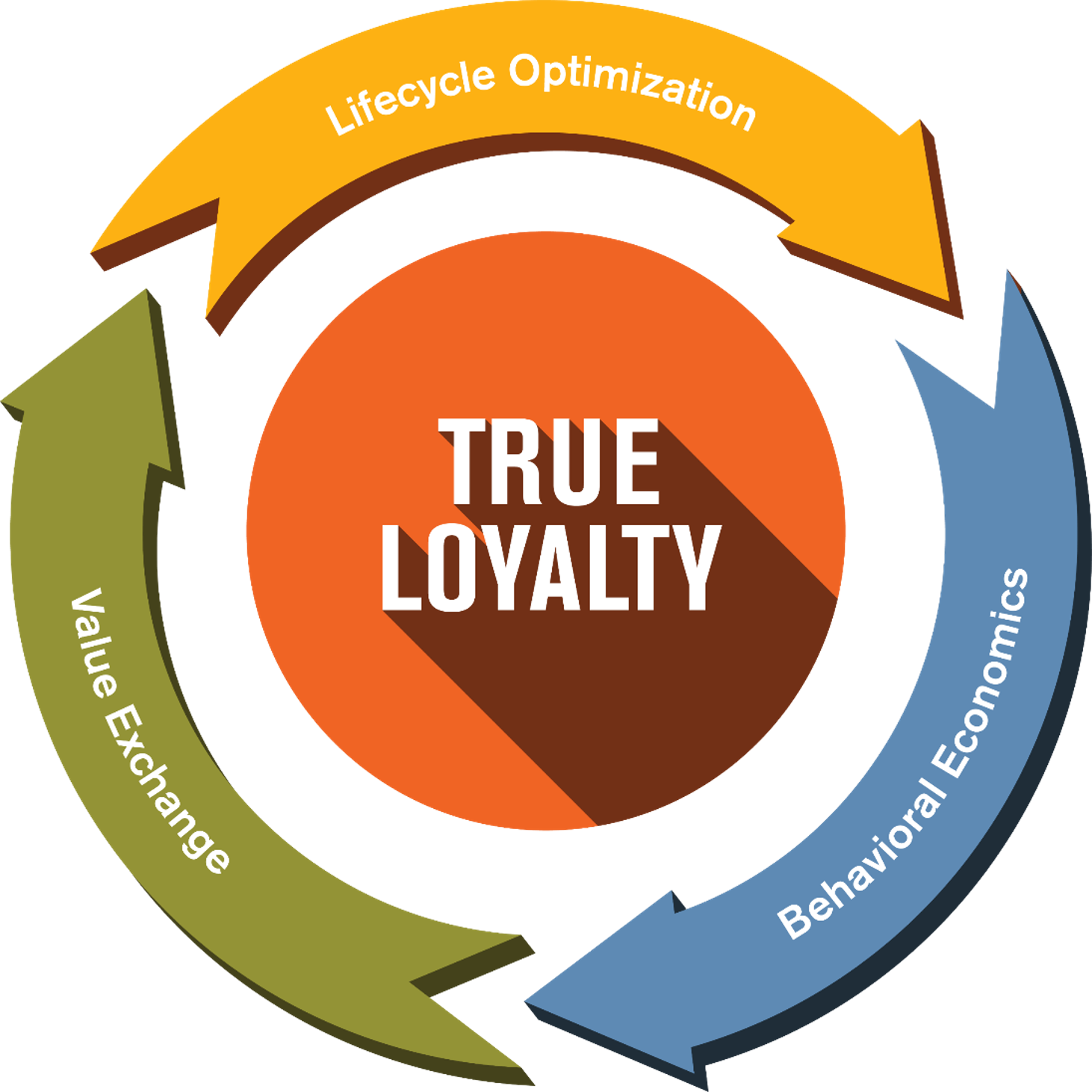

An equitable value exchange is one aspect of how to design a program that drives true customer loyalty. It not only considers the monetary value of a behavior to a company and their goals but also considers what the customer's effort or impact on them is when doing a desired behavior. Here is how to measure the true value of your customer relationships.

Scroll Down

__________

Think about your best customers for a minute. What do they do that is valuable for your business?

__________

This is one of the first questions we ask our clients when we are designing a new loyalty program. Best customers are usually the ones most profitable to your business. They exhibit the best of what you want from your customer base - the key behaviors that either reduce expense, add revenue and/or margin, or both.

Think beyond transactions.

Start by thinking beyond transactions. Your best customers often do things that aren’t necessarily transaction-based. For example, they sign up for paperless billing, or they might refer a friend or business associate, or they share more information about themselves and what’s important to them as a customer. Throughout your customer lifecycle there are critical touchpoints or milestones where you can drive engagement beyond the transaction. Timed right, you can be there with the right communication: an exclusive offer, special recognition or simply a thank you. This drives true loyalty versus mercenary loyalty, where your only activity is driven by dollars off, discounts, rebates or some other transaction-only engagement.

Put yourself in your customer's shoes.

Next, put yourself in your customer’s shoes. Determine how much effort or impact that desired behavior has on them and their engagement with you and your product or service. Think about what’s in it for them, the customer, to do what you’re asking them to do. It’s called “what’s in it for me” or “WIFM” for short. Determining what a specific behavior is worth to your business is essential to understanding how you might ultimately reward a customer for doing – and repeating – that behavior.

Do the math.

How do you figure out the WIFM? Here’s one example: Let’s say one of your key behaviors is to get customers to make a repeat purchase. Pretty straightforward behavior, right? Now let’s say that behavior has a value of $150 but you only have about 30% of your 100,000-customer base doing it. If our loyalty marketing efforts can move the needle 10%, or 3,000 more people make a repeat purchase, that behavior change is now worth $450,000 more to your company. We would then ask you, how much of a reward would you offer to add $450,000 in new value?

We say, let’s do the math! We would run various scenarios of reward values— what would offering a $25 reward ($75,000 cost) or a $50 reward ($150,000 cost) do to the bottom line of the business? We call this the value exchange analysis and it’s a critical step in designing a loyalty program.

Create an equitable value exchange.

An equitable value exchange is one aspect of how to design a program that drives true customer loyalty. It not only considers the monetary value of a behavior to a company and their goals but also considers what the customer’s effort or impact on them is when doing a desired behavior.

To illustrate an equitable value exchange, think about being asked to switch checking accounts. That’s a big ask. Banks routinely offer a $150-$250 reward for doing so. On the other hand, if a company sent you an email with a link to a two minute video introducing you to a new product you might be interested in, that is a small behavior ask. The reward for watching the video might be as simple as saying thank you and providing resources to learn about the new product. Or, if your loyalty program is points-based, you could offer a few points for viewing the video.

Determine what behaviors are worth.

This approach also says the value exchange needs to be equitable. That means the reward for doing a behavior should be commensurate with the required effort it takes or impact it has on the customer. Try ranking your “best customer” behaviors based on what those specific behaviors might be worth to your business. Work on the ones most valuable to your business first and the ones that build on the relationship you have with your customers.

__________

Put your loyalty rewards budget where the math justifies value, adds more "best customers" and builds on your customer relationships. That's how you can drive true loyalty while making smart, measurable use of what you spend on rewarding your loyal customers.

__________

The best way to get started is to get in touch.